-

HMRC is allowing your second self-assessment payment due on 31 July 2020 on account for the tax year 2019/20 to be deferred, due to the Covid-19 pandemic. This means no interest or penalties will be charged on the deferred payment provided it is paid by 31 January 2021. All taxpayers Read More...

-

The adoption in the UK of a transatlantic approach to income tax could appeal to a cash-strapped Chancellor. “…only the little people pay taxes.” That 1980s comment by the New York Hotel owner Leona Helmsley sums up an attitude that many taxpayers still believe to be true. Today the same Read More...

-

The Covid-19 furlough scheme has been effectively revised into a new scheme running from 1 July until 31 October, but this comes with a level of complexity that did not exist in its original guise. Much of the complexity arises because employers can now bring furloughed employees back to work Read More...

-

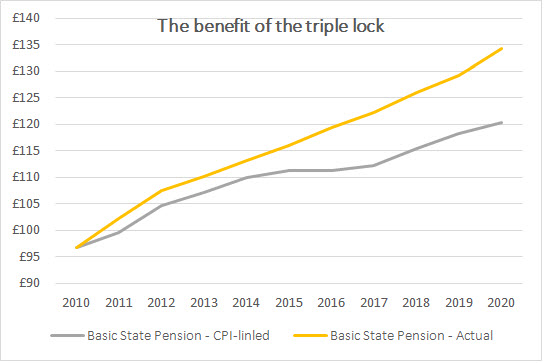

The state pension triple lock may not survive much longer. The impact of Covid-19 on earnings could mean a change in the way that state pensions are increased in each year. If nothing is done, it could give pensioners a large income boost, but cost the government dearly. At present, Read More...

-

Help for consumers to manage their credit and debt has been extended to the end of October. In mid-June, the Financial Conduct Authority (FCA) told firms to extend measures to provide help to people with credit cards, store cards, catalogue credit and personal loans who faced difficulties with their finances Read More...

-

When making tax payments to HMRC, you are currently only charged a fee if you pay by business credit card, while payments by personal credit card are not permitted. However, from 1 November 2020, payments made using a business debit card will also attract a fee. The rationale behind the Read More...